My teenagers see me use a credit card all the time, but when I asked, they don’t really know how they work. So, we are going to square one and exploring how credit cards work. If you already understand credit cards, and can use them responsibly, great! But, perhaps you are struggling a bit with your credit card, or know someone who could use a better understanding. If so, please read on.

Credit cards are not money.

I think this is the single biggest misconception about credit cards. That little piece of plastic is not a dispenser of funds. Credit cards are a tool for spending. When you have a credit card, you are given a line of credit. Perhaps you have a limit of $5,000. That does not mean you have access to $5,000. It means you can put $5,000 of purchases on your account before you will be blocked from spending.

Let’s take a pretend trip to the store to see how the credit card does work. When I go to the grocery store, I put all the groceries in my cart. When I check out, the total comes to $84.67. I put my credit card in the machine, and my purchase is approved. From the store’s perspective, I am paid in full. But, instead of owing money to the store, I now owe money to the credit card company. The credit card simply allowed me to defer payment for a few days. When my credit card bill arrives, all purchases I made in the last month will be due at the same time. If I have planned for this and only made purchases with money I already knew I had, then this is very convenient. If I spent carelessly with my card, this is a deathblow. Because, if I don’t pay the full amount each month, I will be charged interest on those purchases. Now, my groceries didn’t cost $84.67; they cost $95.48. If I continue to not pay, the price for those groceries will keep going up.

Credit cards make it easy to overspend.

When you make a purchase at a store, and have to count out those dollars and cents, you have an emotional response to that purchase. You see the money leaving your hand. You see that there is less money left in your wallet. With a credit card, however, you put the card in the machine, and then you put it back in your wallet. You didn’t give anything up to make the purchase. Physically speaking, there was no exchange, and you can get tricked into thinking that the item cost nothing. Without a proper understanding of how credit cards work, it is too easy to hand that card over and spend more money than you have.

Bills must be paid on time.

Credit card companies provide a service, convenience, but it does have a price tag. If you pay the full amount due on your card each month, you can avoid the credit card price tag. If, however, you don’t pay the full amount, and only pay the mimimum payment, you will be charged interest on your balance. Considering that credit card interest rates can run anywhere from 13-22%, depending on the card type, this can be a big pill to swallow. If you don’t pay anything at all on your bill, you will also be charged fees, which can be $30 or more. While the convenience of credit cards is amazing, if you don’t plan and pay the bill when due, the convenience will cost you a world of trouble.

I have missed a due date a few times, and had to pay the fees, so I try to make multiple payments in a month to avoid that. I find that if I double check my purchases and pay the bill in full every 1-2 weeks, I am never caught off guard.

Many financial experts will recommend that you cut up all your credit cards and use only cash. This is wise advice, except for a few problems. The biggest problem for me is that I live in a rural area and depend on online purchases to fill in the gaps in my local stores. I can’t pay for items online with cash. The idea of a debit card doesn’t thrill me, so I use a credit card. To keep it in check, I have only one card to keep track of, and as I mentioned before, I pay it off at least once a month, and try to pay multiple times a month.

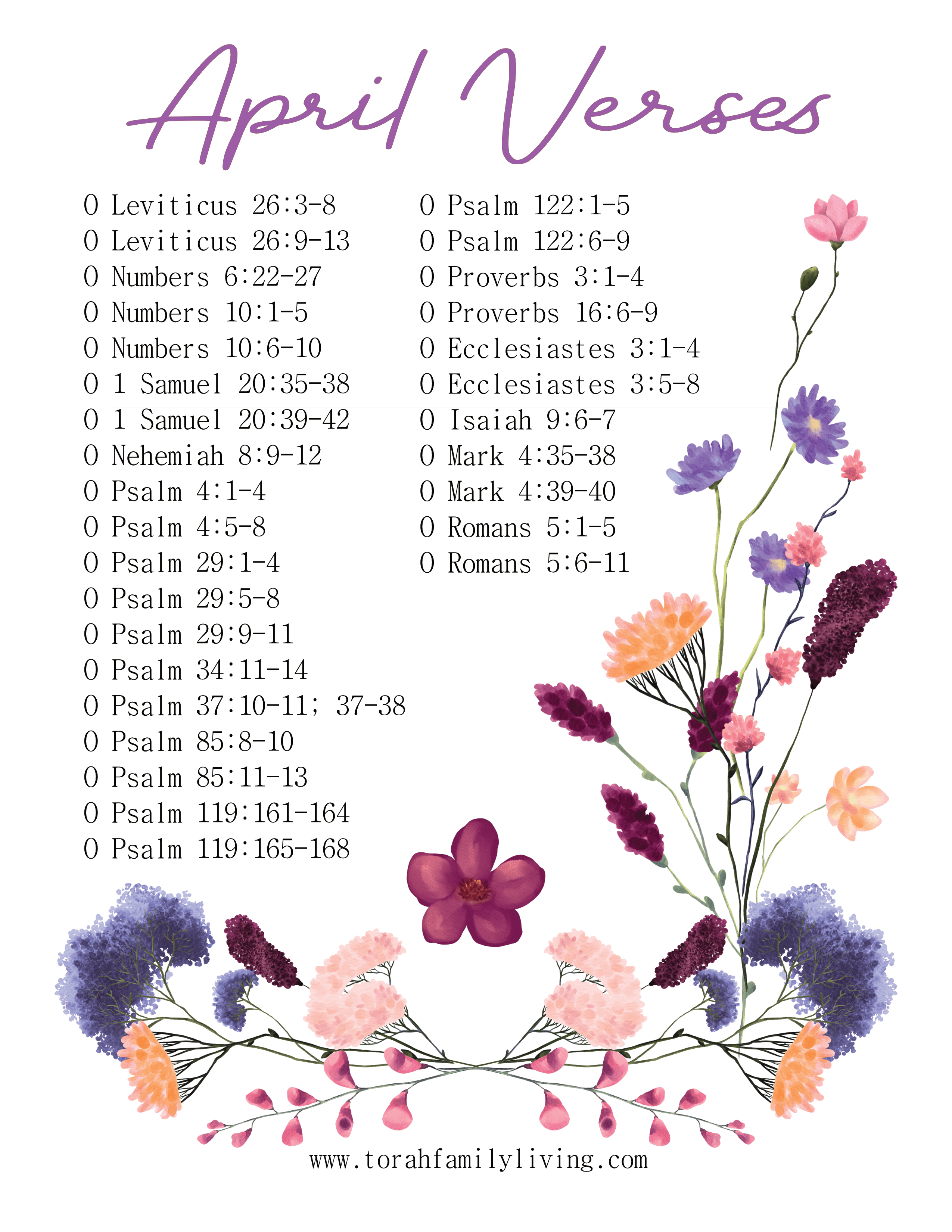

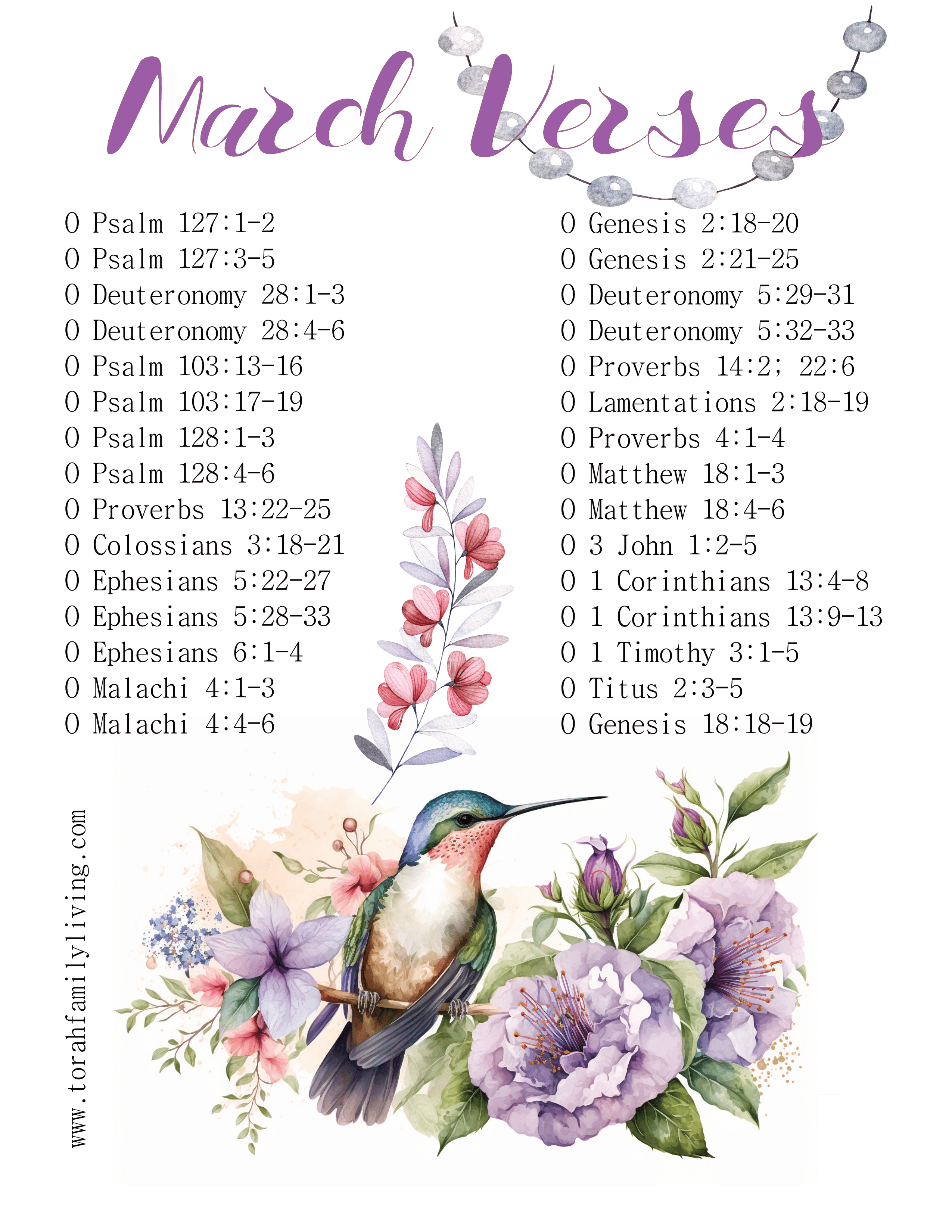

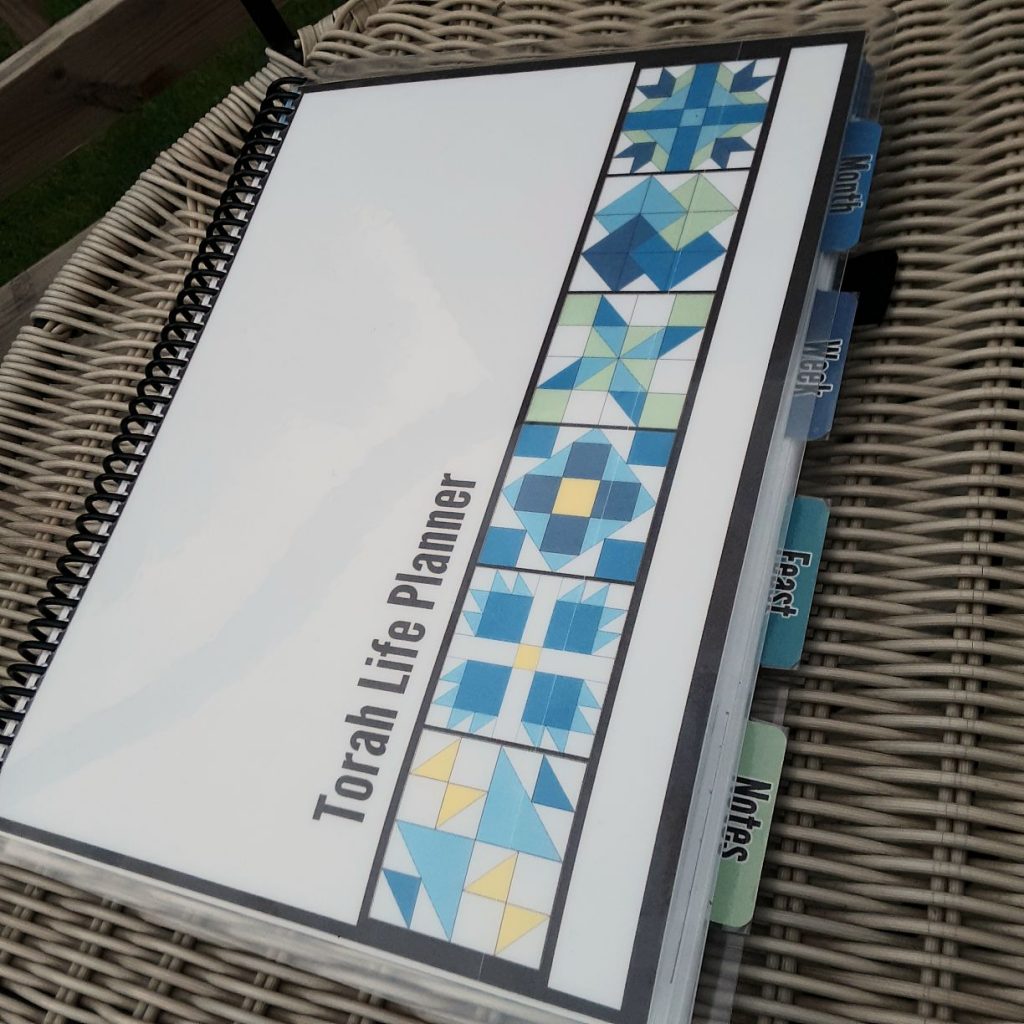

Torah Life Planner

The Torah Life Planner will not only help you keep track of life, but it will help you stay focused on your Torah journey.

Handmade.

Good records are essential.

Obviously, to be able to use a credit card, you must keep good records. You need to know how much money you actually have, and you need to keep track of all purchases made with your card. Your due date needs to be marked clearly on your calendar, as well.

I will be showing you how I keep track of my purchases in another post. If you don’t have a system, start by keeping a running list of purchases so that you won’t be surprised when the bill arrives. You can also take advantage of credit card apps that give you access to your account anytime, anywhere. I also highly recommend that if you choose to have a credit card, you limit yourself to only one. Any more than that is too hard to maintain and track.

Action steps

- Limit yourself to one card.

- Mark your due date on your calendar.

- Keep a running list of purchases.

- Aim to pay in full every month, ideally more than once a month.